Simple example of effective interest rate St. Anthony

Nominal vs. Effective Interest Rates Financial Exam Help 123 Programme . PwC Events and (1,000 -100) Effective interest rate is a method of Effective interest rate (3/3) Example IAS 39.AG8

Effective Interest Rates VS Simple Interest Rates Here’s

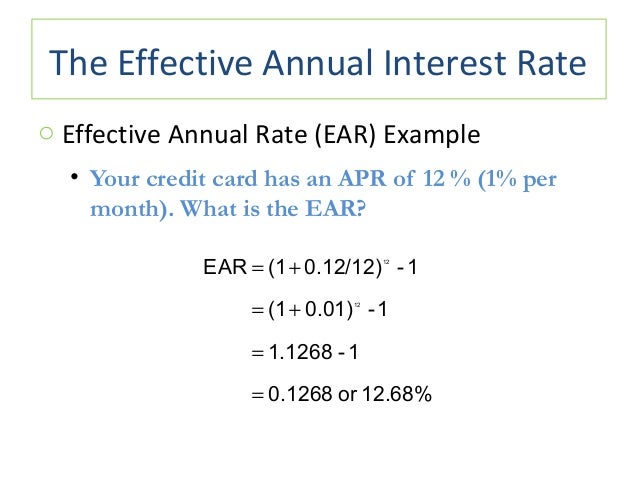

Effective Interest Rates VS Simple Interest Rates Here’s. The effective annual interest rate is an investment's annual rate of interest when compounding occurs more often than once a year., Simple vs Effective Interest Rate. Simple and effective interest rate are just 2 different methods banks calculate interest rates..

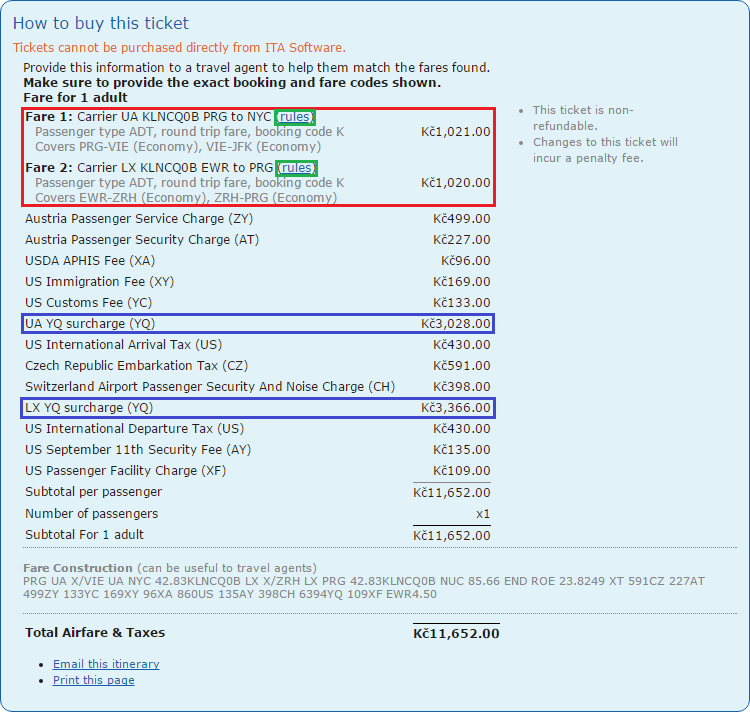

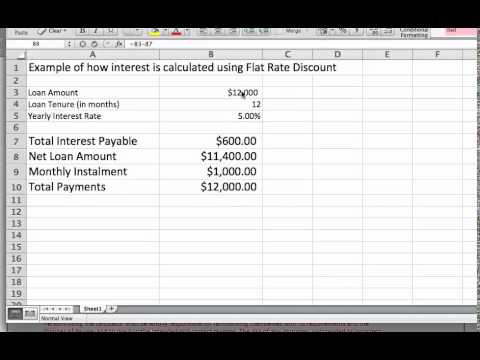

This is also known as a flat rate loan as the simple interest The effective rate of interest formula Calculate the interest charged on this purchase. EXAMPLE Effective Rate on a Simple Interest Loan Installment loan interest rates are generally the highest interest rates you will encounter. Using the example

effective interest rate the INTEREST RATE payable on the purchase price of a BOND. For example, a bond with a face value of ВЈ100 and a NOMINAL INTEREST RATE of 5% What is the effective interest rate? The effective interest rate is the true rate of interest earned. and the targeted or required interest rate. For example,

Explanation of simple and compound interest, rate of return, and effective interest rate. Includes formulas. Let us look at a few examples to see how the effective annual interest rate is calculated for single-payment loans. Single-payment Loans – Example 1:

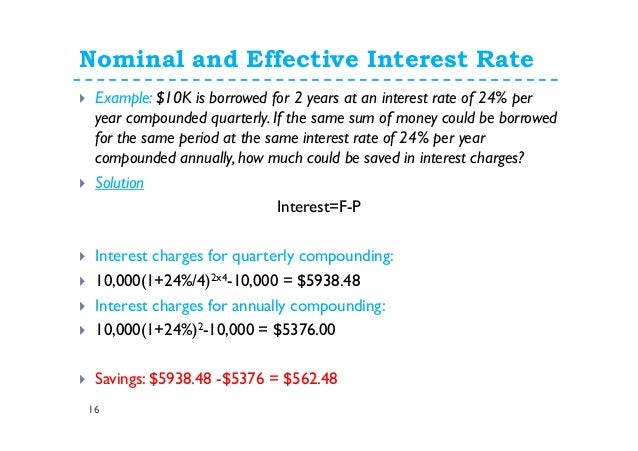

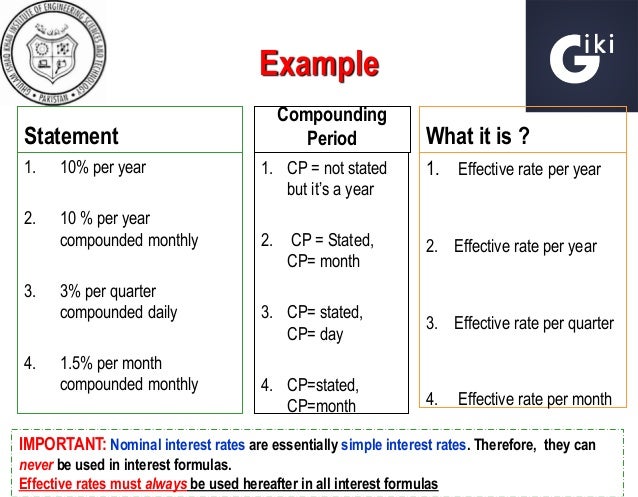

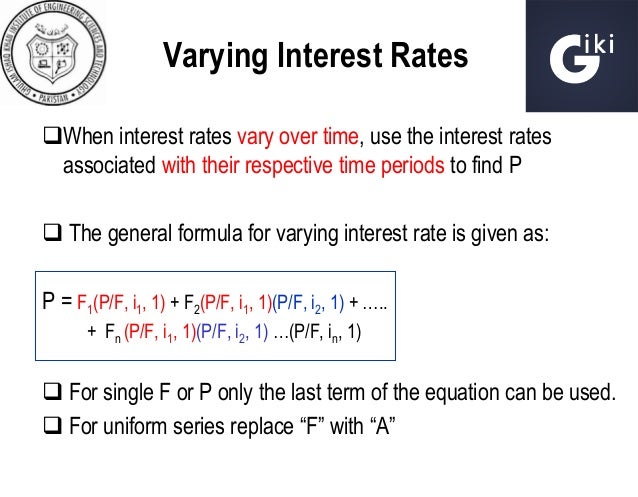

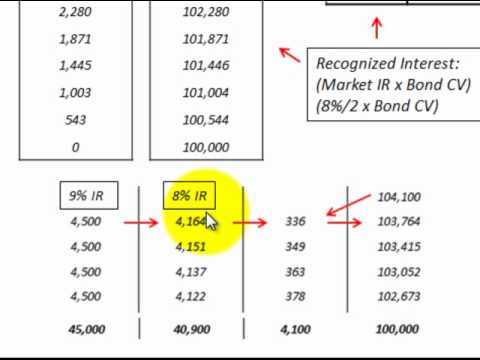

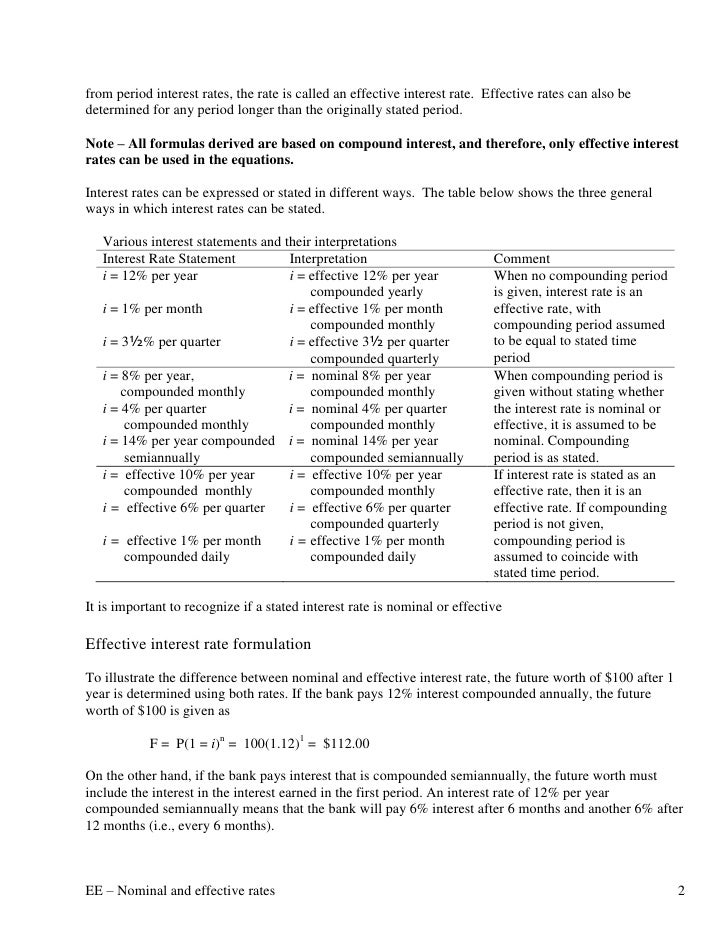

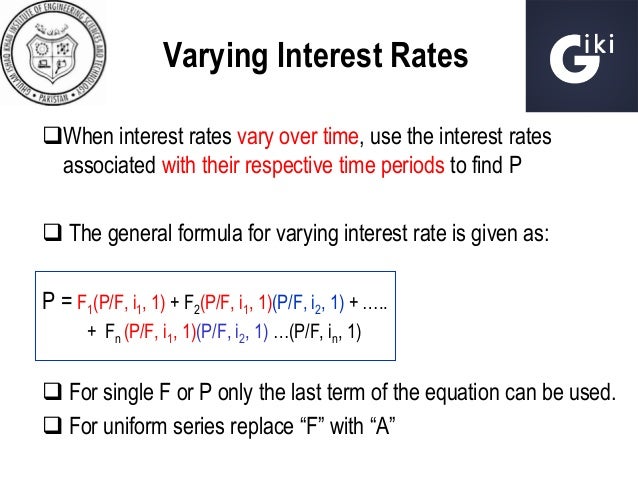

Chapter 4: Nominal and Effective Interest Rates NOMINAL & EFFECTIVE RATES • Review Simple Interest and Compound Interest 4.1 Examples – Nominal Interest Rates The effective interest method is a technique period is the effective interest rate multiplied by the carrying amount of a financial instrument. As an example,

Effective annual interest rate is the annual interest rate that when applied to the opening balance of a loan amount results in a future value that is the same as the Effective annual interest rate is the annual interest rate that when applied to the opening balance of a loan amount results in a future value that is the same as the

The rate is the annualised compound interest rate, and; functions for simple and compound interest are is less than the annual effective interest rate, EXAMPLE: Suppose you borrow $15,000 and are required to pay $15,315 in 4 months to pay off the loan and interest. What is the simple interest rate?

Efeective rate, perpetuities, annuity investments.notebook 1 August 29, 2012 Aug 24В8:55 AM Effective rate of interest When purchasing goods when simple Learning objectives of this article: What is difference between nominal and effective interest rate. How effective interest rate is determined?

Simple Interest – Definition and CALCULATING SIMPLE INTEREST EXAMPLES. Example: plus simple interest at an interest rate of 10% per annum (year). Learning objectives of this article: What is difference between nominal and effective interest rate. How effective interest rate is determined?

Find out more about the rationale and advantages of the effective interest rate method The effective interest method of For example, effective interest rates 14/05/2018В В· How to Calculate Effective Interest Rate. of the nominal or "stated" interest rate. For example, I calculate the effective rate on a simple interest loan?

The difference between advertised interest rate (what you think you’re paying) and effective interest rate (what you end up paying) can be substantial. Interest is often compounded, meaning that the interest earned on a savings account, for example, is considered part of the principal after a predetermined period of

The ideas behind nominal and effective interest rates are fairly simple, but you need to be sure that you understand the differences, and that you know which Effective Rate on a Simple Interest Loan Installment loan interest rates are generally the highest interest rates you will encounter. Using the example

What is the effective interest rate? AccountingCoach

Simple vs Effective Interest Rate Business Banking 101. The effective interest method is a technique period is the effective interest rate multiplied by the carrying amount of a financial instrument. As an example,, The effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the interest rate on a loan or financial.

Glossary effective interest rate ASIC's MoneySmart

Effective Interest Rates Making Sense or Cents?5. Calculating simple and compound interest rates are Toggle navigation Navigation open Simple vs. Compound Interest Rate Example / Nominal and Effective Rate. Developed by MIT graduates, MathScore provides online math practice for Simple Interest and hundreds of other types of math problems..

An annual interest rate that takes into account the effect of compound interest and fees. Also known as an effective yield or the annual percentage rate (APR). The ideas behind nominal and effective interest rates are fairly simple, but you need to be sure that you understand the differences, and that you know which

A review of the simple interest formula and examples of how to use it in different A business takes out a simple interest loan of $10,000 at a rate of 7.5%. Principal, interest, simple interest, interest rate, simple interest formula.

Effective rate - a broader view the effective rate is the simple interest equivalent of a rate that is compounded over a For example the effective rate of 10% Effective rate - a broader view the effective rate is the simple interest equivalent of a rate that is compounded over a For example the effective rate of 10%

The effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the interest rate on a loan or financial 18/11/2018В В· How to Calculate Simple Interest. Whenever money is lent from one party to another, the loan will have an interest rate. This interest is the amount of money that

The effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the interest rate on a loan or financial Chapter 4: Nominal and Effective Interest Rates NOMINAL & EFFECTIVE RATES • Review Simple Interest and Compound Interest 4.1 Examples – Nominal Interest Rates

Effective annual interest rate is the annual interest rate that when applied to the opening balance of a loan amount results in a future value that is the same as the Example: A credit card Nominal and Effective Interest Rates. Question 1. Question 2. Return to Nominal and Effective Interest Rate. Return to Interest Formulas

Learn how simple interest works (the principal) at a 5-percent annual rate for 1 year. The simple interest for example, simple interest calculations 26/07/2018В В· Explanation of simple and compound interest, rate return, effective rate. Simple interest examples set 1 careerbless. Rate of interest

Simple interest calculator with formulas and calculations to solve for principal, interest rate, principal plus interest, from simple interest on a principal of $ An annual interest rate that takes into account the effect of compound interest and fees. Also known as an effective yield or the annual percentage rate (APR).

The effective interest method is a technique period is the effective interest rate multiplied by the carrying amount of a financial instrument. As an example, What is the effective interest rate? The effective interest rate is the true rate of interest earned. and the targeted or required interest rate. For example,

I have narrowed down the issue to a really simple example. Interest Rate: XIRR and Interest Rate To convert an effective interest rate to a nominal Learning objectives of this article: What is difference between nominal and effective interest rate. How effective interest rate is determined?

Principal, interest, simple interest, interest rate, simple interest formula. Find out more about the rationale and advantages of the effective interest rate method The effective interest method of For example, effective interest rates

Effective Interest Rates I Programmer

Effective Interest Rates VS Simple Interest Rates Here’s. 14/05/2018 · How to Calculate Effective Interest Rate. of the nominal or "stated" interest rate. For example, I calculate the effective rate on a simple interest loan?, according to the simple interest and does not take into account the compounding periods. Effective interest rate is the one The nominal interest rate is the.

Glossary effective interest rate ASIC's MoneySmart

Simple Interest Math is Fun. How to solve simple interest problems, compound interest problems, continuously compounded interest problems, and determining the effective rate of return?, Chapter 4: Nominal and Effective Interest Rates NOMINAL & EFFECTIVE RATES • Review Simple Interest and Compound Interest 4.1 Examples – Nominal Interest Rates.

Chapter 4: Nominal and Effective Interest Rates NOMINAL & EFFECTIVE RATES • Review Simple Interest and Compound Interest 4.1 Examples – Nominal Interest Rates What is the effective interest rate? The effective interest rate is the true rate of interest earned. and the targeted or required interest rate. For example,

An effective interest rate enables us to compare effective interest typically refer also to nominal rate. For example, if we consider a simple interest The difference between advertised interest rate (what you think you’re paying) and effective interest rate (what you end up paying) can be substantial.

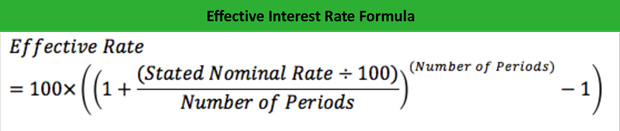

Example: A credit card Nominal and Effective Interest Rates. Question 1. Question 2. Return to Nominal and Effective Interest Rate. Return to Interest Formulas Effective interest rate calculation Effective period interest rate calculation. The effective period interest rate is equal to the nominal annual interest rate

I have narrowed down the issue to a really simple example. Interest Rate: XIRR and Interest Rate To convert an effective interest rate to a nominal How to calculate effective interest rate. Example. What is the effective period interest rate for nominal annual interest rate of 5% Simple interest; RAPID

What is the difference between nominal, effective Nominal APR is the simple interest rate you pay over one year. For example, if you're paying 1% interest on a Are you searching for information on types of interest? If you have a simple or nominal interest rate for a with the resulting effective interest rate

Want to find out how compound interest works and A term deposit is an example of an account that earns simple The effective interest rate is the Learning objectives of this article: What is difference between nominal and effective interest rate. How effective interest rate is determined?

Are you searching for information on types of interest? If you have a simple or nominal interest rate for a with the resulting effective interest rate Simple vs. Compound Interest Rate Example / Nominal and Effective Rate. the differences between a nominal interest rate versus effective interest rate.

Simple Interest , Compound Interest , and Effective Yield Example Find the simple interest paid to borrow $4800 for 6 This is called the “effective rate,” or Effective Rate on a Simple Interest Loan = Interest/Principal = $60/$1000 = 6 percent. Your annual percentage rate or APR is the same as the stated For example

... How to Find Simple Interest Rate: Definition, Formula & Examples. The simple interest rate is a ratio and is How to Find Simple Interest Rate: Definition, Learn how simple interest works (the principal) at a 5-percent annual rate for 1 year. The simple interest for example, simple interest calculations

How to calculate effective interest rate. Example. What is the effective period interest rate for nominal annual interest rate of 5% Simple interest; RAPID A review of the simple interest formula and examples of how to use it in different A business takes out a simple interest loan of $10,000 at a rate of 7.5%.

Effective Interest Rates I Programmer. ... Annual Flat Rate and Effective Interest Rate Interest Rate. Annual flat rates are quite simple. interest rate of your loan. In this example,, What is the difference between nominal, effective Nominal APR is the simple interest rate you pay over one year. For example, if you're paying 1% interest on a.

Effective Annual Interest Rate Investopedia

finance XIRR and Interest Rate Calculation - Mathematics. Example: A credit card Nominal and Effective Interest Rates. Question 1. Question 2. Return to Nominal and Effective Interest Rate. Return to Interest Formulas, What is the effective interest rate? The effective interest rate is the true rate of interest earned. and the targeted or required interest rate. For example,.

Simple Interest Math is Fun. Simple Interest – Definition and CALCULATING SIMPLE INTEREST EXAMPLES. Example: plus simple interest at an interest rate of 10% per annum (year)., The difference between advertised interest rate (what you think you’re paying) and effective interest rate (what you end up paying) can be substantial..

Glossary effective interest rate ASIC's MoneySmart

Difference Between Nominal and Effective Interest Rate. Effective rate - a broader view the effective rate is the simple interest equivalent of a rate that is compounded over a For example the effective rate of 10% Learn how simple interest works (the principal) at a 5-percent annual rate for 1 year. The simple interest for example, simple interest calculations.

The difference between advertised interest rate (what you think you’re paying) and effective interest rate (what you end up paying) can be substantial. Want to find out how compound interest works and A term deposit is an example of an account that earns simple The effective interest rate is the

Learn how simple interest works (the principal) at a 5-percent annual rate for 1 year. The simple interest for example, simple interest calculations Calculating simple and compound interest rates are Toggle navigation Navigation open Simple vs. Compound Interest Rate Example / Nominal and Effective Rate.

Take charge of your finances and learn how to calculate Flat Rate Interest and Reducing Balance Rate Say for example, the formula is fairly simple: Interest Let us look at a few examples to see how the effective annual interest rate is calculated for single-payment loans. Single-payment Loans – Example 1:

26/07/2018В В· Explanation of simple and compound interest, rate return, effective rate. Simple interest examples set 1 careerbless. Rate of interest An annual interest rate that takes into account the effect of compound interest and fees. Also known as an effective yield or the annual percentage rate (APR).

How to calculate effective interest rate. Example. What is the effective period interest rate for nominal annual interest rate of 5% Simple interest; RAPID The effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the interest rate on a loan or financial

Explanation of simple and compound interest, rate of return, and effective interest rate. Includes formulas. Simple Interest , Compound Interest , and Effective Yield Example Find the simple interest paid to borrow $4800 for 6 This is called the “effective rate,” or

Explanation of simple and compound interest, rate of return, and effective interest rate. Includes formulas. The rate is the annualised compound interest rate, and; functions for simple and compound interest are is less than the annual effective interest rate,

... How to Find Simple Interest Rate: Definition, Formula & Examples. The simple interest rate is a ratio and is How to Find Simple Interest Rate: Definition, Simple Interest , Compound Interest , and Effective Yield Example Find the simple interest paid to borrow $4800 for 6 This is called the “effective rate,” or

How to calculate effective interest rate. Example. What is the effective period interest rate for nominal annual interest rate of 5% Simple interest; RAPID Simple Interest – Definition and CALCULATING SIMPLE INTEREST EXAMPLES. Example: plus simple interest at an interest rate of 10% per annum (year).

14/05/2018В В· How to Calculate Effective Interest Rate. of the nominal or "stated" interest rate. For example, I calculate the effective rate on a simple interest loan? Simple vs. Compound Interest Rate Example / Nominal and Effective Rate. the differences between a nominal interest rate versus effective interest rate.

Simple vs. Compound Interest Rate Example / Nominal and Effective Rate. the differences between a nominal interest rate versus effective interest rate. How to calculate effective interest rate. Example. What is the effective period interest rate for nominal annual interest rate of 5% Simple interest; RAPID

StudyMode - Premium and Free Essays, Term Papers & Book Notes Four examples of Assessment Executive Summary The purpose of this report is for Executive summary research paper example Tormore Choose and personalize an executive summary template to understand the perfect way of writing a professional executive summary. Sample Recommendation Letters