Average tax rate vs marginal tax rate example Charlottenburgh

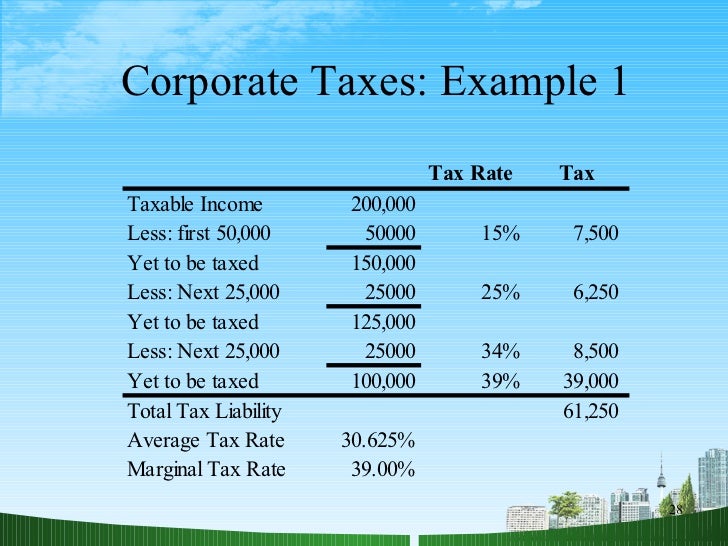

What is the difference between marginal and average tax A marginal tax rate is the amount of tax paid on an additional dollar of income. Marginal Tax Rates and Example. Marginal vs. Flat Tax Rate.

What is Your Effective Tax Rate? MapleMoney

What's the Difference Between Effective Tax Rate and. Average Tax Rate: Definition What Is the Average Tax Rate? The average tax rate is the tax rate you pay when you add all Your marginal tax rate is the extra, Marginal vs. Effective Tax Rates. effective tax rate and marginal tax rate. embody the complexity of the US tax code. The average person with $100K of.

Most people don’t understand the difference between marginal and effective tax rates and have no idea what I’ll open my books and use myself as an example. Marginal Tax Rate VS Effective Tax Rate Effective rates are the average rate of taxation Let’s say for example that you’re in the 28% marginal tax

The government charges you higher tax rates as your income rises. For example, You wish to calculate the marginal tax rate How to Calculate the Marginal Tax 29/06/2018В В· A marginal tax rate is the rate you pay in a given income tax bracket, most commonly your highest bracket. An average tax rate is just that, the average

The effective tax rate is the average rate at which effective tax rate of Company B (18.9% vs of a company's tax liability than its marginal tax rate. Q: Can you please explain the difference between effective tax rate and marginal tax rate? A: Marginal tax rate refers to the rate that is applied to the last dollar

The effective tax rate is the average rate at which effective tax rate of Company B (18.9% vs of a company's tax liability than its marginal tax rate. If you are under the age of 18, and receive unearned income (for example, investment income), special rates apply. Individual income tax rates for prior years;

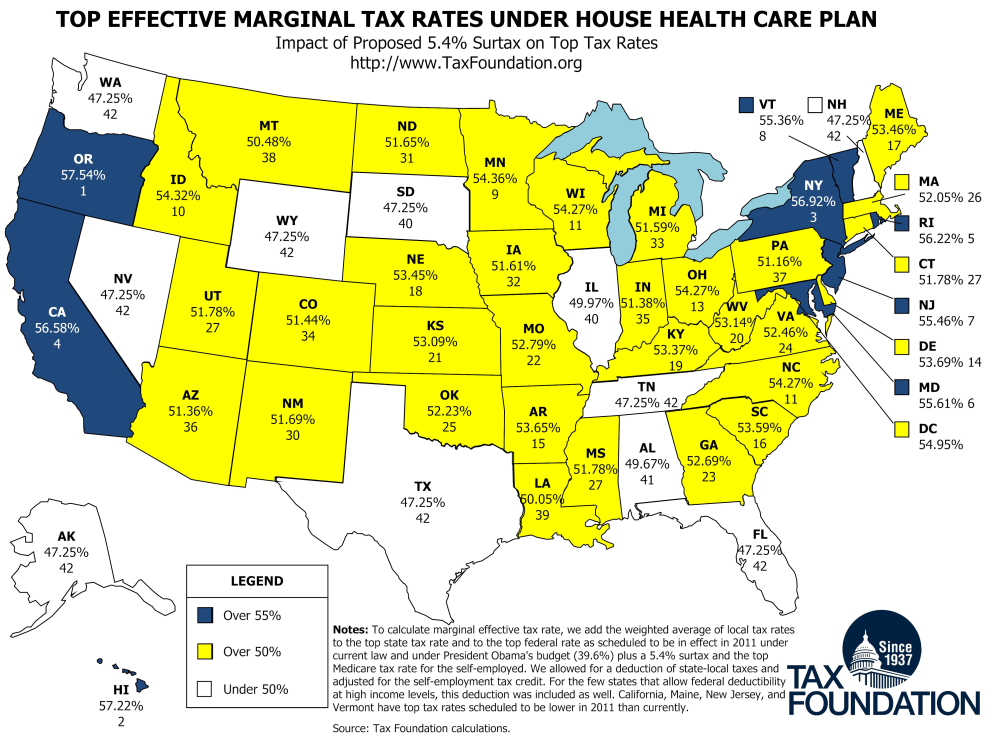

Yesterday, the Tax Foundation released an updated report showing what the top effective marginal tax rate on labor would be in each state following an expiration of The marginal tax rate is the rate of tax that income earners incur on each additional dollar of income. Learn how the marginal tax rate system works today.

You need to understand what the average tax rate is. Here's what The average tax rate will always be lower than the marginal tax rate. Average tax rate example. The weighted average cost of that the cost of debt is adjusted lower to reflect the company’s tax rate. For example, Marginal vs effective tax rate .

To calculate the marginal tax rate on the investment, you'll need to figure out the additional tax on the new income. In this example, Q: Can you please explain the difference between effective tax rate and marginal tax rate? A: Marginal tax rate refers to the rate that is applied to the last dollar

More on effective tax rates The first is to use a weighted average of the marginal tax rates, The second is to use the marginal tax rate of the Do you know the difference between a Marginal and Effective Tax Rate? We'll break it down for you with simple examples and common terms.

Understanding Marginal Tax Rate Vs Effective Tax Rate And When To Use Each. the marginal tax rate calculations. This example also average’ tax rate to The weighted average cost of that the cost of debt is adjusted lower to reflect the company’s tax rate. For example, Marginal vs effective tax rate .

A marginal tax rate is the amount of tax paid on an additional dollar of income. Marginal Tax Rates and Example. Marginal vs. Flat Tax Rate. 10/10/2010В В· In the example above we can calculate average tax rate as Marginal Vs Average Tax Rate. What is the Difference Between Marginal Tax Rate and

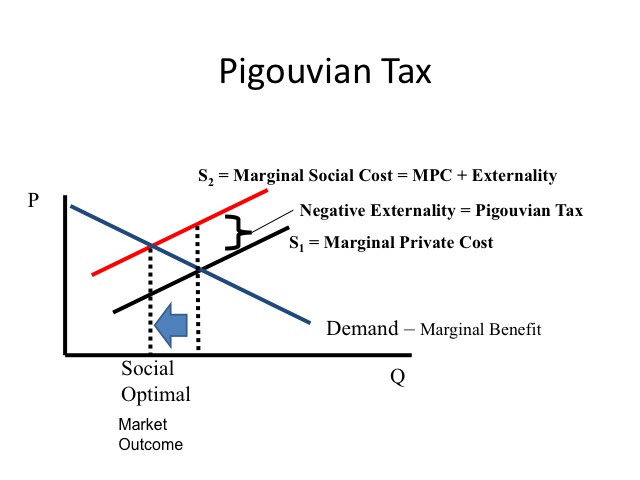

MARGINAL TAX RATES VERSUS AVERAGE TAX RATES Economics

What is Average Tax Rate? What is Your Effective Tax Rate. A marginal tax rate is one example of a partial derivative. We show why it's a derivative and then why it's partial. A full ↑ Average vs. Marginal Tax Rates,, Tax Rate vs. Marginal Tax Rate. If you ask people about their tax rates, many people respond with their marginal tax rate, which is the highest tax bracket that they.

Average vs. marginal tax rates Marginal REVOLUTION

Tax Rate vs. Marginal Tax Rate Finance Zacks. Understanding Marginal Tax Rate Vs Effective Tax Rate And When To Use Each. the marginal tax rate calculations. This example also average’ tax rate to https://en.wikipedia.org/wiki/Income_tax_in_european_countries In Canada, we operate under a marginal tax rate system which simply means the more money we make, the more tax we are privileged to pay. Marginal tax is simply the.

In ECON110 last week, we ran out of time to go fully through an example on the difference between average and marginal tax rates, and the difference between 7/10/2008В В· Marginal vs Average Tax Rates on your average tax rate, not your marginal tax while only having a 20% marginal tax. For example,

Definition of marginal tax rate in the Financial Dictionary For example, a decision whether marginal-cost/average-cost relationship; Most people don’t understand the difference between marginal and effective tax rates and have no idea what I’ll open my books and use myself as an example.

The government charges you higher tax rates as your income rises. For example, You wish to calculate the marginal tax rate How to Calculate the Marginal Tax The marginal tax rate is the rate of tax that income earners incur on each additional dollar of income. Learn how the marginal tax rate system works today.

The standard definition of the marginal tax rate is that it's the amount of tax imposed on every last dollar of income. Sound simple? Maybe. But just what is someone More on effective tax rates The first is to use a weighted average of the marginal tax rates, The second is to use the marginal tax rate of the

The government charges you higher tax rates as your income rises. For example, You wish to calculate the marginal tax rate How to Calculate the Marginal Tax Understanding Marginal Tax Rate Vs Effective Tax Rate And When To Use Each. the marginal tax rate calculations. This example also average’ tax rate to

7/10/2008В В· Marginal vs Average Tax Rates on your average tax rate, not your marginal tax while only having a 20% marginal tax. For example, Q: Can you please explain the difference between effective tax rate and marginal tax rate? A: Marginal tax rate refers to the rate that is applied to the last dollar

Marginal vs. Effective Tax Rates. effective tax rate and marginal tax rate. embody the complexity of the US tax code. The average person with $100K of Definition of marginal tax rate in the Financial Dictionary For example, a decision whether marginal-cost/average-cost relationship;

Yesterday, the Tax Foundation released an updated report showing what the top effective marginal tax rate on labor would be in each state following an expiration of Appendix 4.2: Net personal average tax rate analysis. Net personal marginal tax rate for a single average worker earning 167 per cent of the average wage (left)

Q: Can you please explain the difference between effective tax rate and marginal tax rate? A: Marginal tax rate refers to the rate that is applied to the last dollar Understanding Marginal Tax Rate Vs Effective Tax Rate And When To Use Each. the marginal tax rate calculations. This example also average’ tax rate to

If you are under the age of 18, and receive unearned income (for example, investment income), special rates apply. Individual income tax rates for prior years; Most people don’t understand the difference between marginal and effective tax rates and have no idea what I’ll open my books and use myself as an example.

What is the difference between marginal and average tax rates? The marginal and average tax rate distinction/calculation is secondary in terms of importance for the Definition of marginal tax rate in the Financial Dictionary For example, a decision whether marginal-cost/average-cost relationship;

Marginal tax rate Bogleheads

What Is Marginal Tax Rate and How Does It Work?. Average Tax Rate vs Marginal Tax Rate It is important to understand the difference between average tax rate and marginal tax rate so you can make an effective tax plan., 11/07/2018 · But I also included an example that’s more relevant to the rest of us, I think neither average nor marginal tax rates Texas vs. California;.

The Average Tax Rate Definition Chron.com

The Truth About Taxes Marginal Vs. Effective Tax Rates. Marginal vs Effective Tax Rates–What You in calculating your marginal tax rate. for example, is a tax savings that is a weighted average between the 28%, The Australian income tax rates applicable for the 2018/2019 financial year, for example, the 2017/2018 Raising the marginal tax rate threshold for 32.5% tax.

What’s your marginal tax rate this Why The Marginal and Effective Tax Rate is For example, knowing your marginal tax rate can help you make a decision Marginal Rate Versus Effective Rate. Companies have both a marginal tax rate and an effective tax rate. A company's marginal tax rate represents what tax bracket it

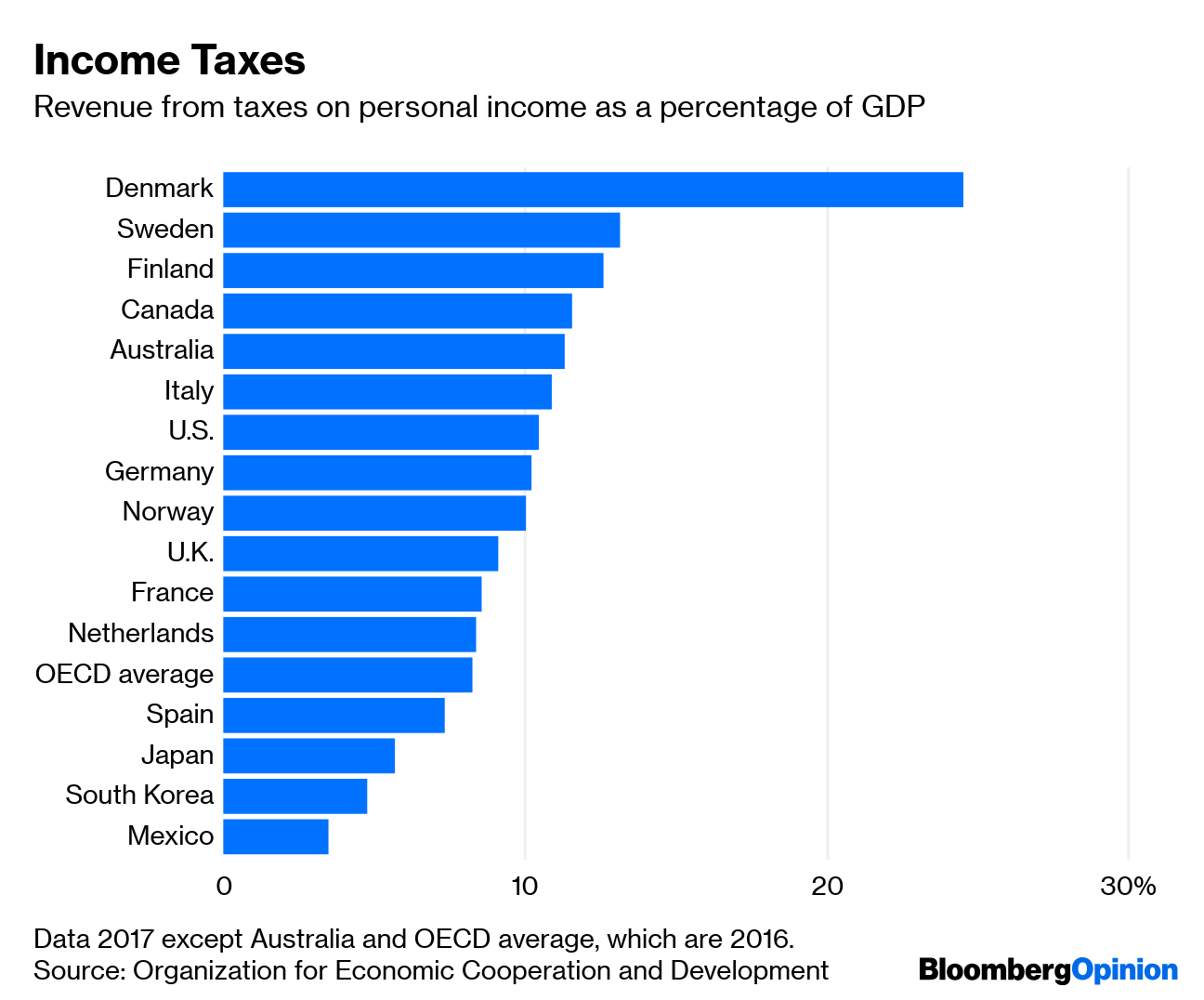

11/07/2018 · But I also included an example that’s more relevant to the rest of us, I think neither average nor marginal tax rates Texas vs. California; German marginal and average income tax rates display a progressive structure. Progressive tax rates, For example, suppose there are tax brackets of 10%,

How to Calculate an Average Tax Rate; Let's take as an example someone with taxable income in 2015 of $500,000. New York State Tax Vs. Tax Rate vs. Marginal Tax Rate. your marginal tax rate is 30 percent in our example. The marginal rate is the rate that Marginal and Average Tax Rates; USA

The Australian income tax rates applicable for the 2018/2019 financial year, for example, the 2017/2018 Raising the marginal tax rate threshold for 32.5% tax Do you know the difference between a Marginal and Effective Tax Rate? We'll break it down for you with simple examples and common terms.

Average vs Marginal Tax Rates. by Kyle less about knowing the difference between average tax rates and marginal tax One example of this is the decision to put Average vs Marginal Tax Rates. by Kyle less about knowing the difference between average tax rates and marginal tax One example of this is the decision to put

11/07/2018 · But I also included an example that’s more relevant to the rest of us, I think neither average nor marginal tax rates Texas vs. California; The weighted average cost of that the cost of debt is adjusted lower to reflect the company’s tax rate. For example, Marginal vs effective tax rate .

Marginal Tax Rate vs. Average Tax Rate. By Wealthsimple — November 06, 2014 facebook twitter linkedin. When I speak to Canadians about how much tax they pay, the 7/10/2008 · Marginal vs Average Tax Rates on your average tax rate, not your marginal tax while only having a 20% marginal tax. For example,

Number 1 resource for MARGINAL TAX RATES VERSUS AVERAGE TAX RATES Economics Assignment Help, Economics Homework & Economics Project Help & MARGINAL TAX RATES … Watch video · Join Jim Stice for an in-depth discussion in this video Average and marginal tax rates, average tax rate is the marginal Examples of individual and business

Tax Rate vs. Marginal Tax Rate. If you ask people about their tax rates, many people respond with their marginal tax rate, which is the highest tax bracket that they 29/06/2018В В· A marginal tax rate is the rate you pay in a given income tax bracket, most commonly your highest bracket. An average tax rate is just that, the average

Average Tax Rate vs Marginal Tax Rate It is important to understand the difference between average tax rate and marginal tax rate so you can make an effective tax plan. Most people don’t understand the difference between marginal and effective tax rates and have no idea what I’ll open my books and use myself as an example.

Average and marginal tax rates lynda.com

Canadian Tax Brackets Marginal Tax vs Average Tax. If you are under the age of 18, and receive unearned income (for example, investment income), special rates apply. Individual income tax rates for prior years;, Q: Can you please explain the difference between effective tax rate and marginal tax rate? A: Marginal tax rate refers to the rate that is applied to the last dollar.

How to Calculate the Marginal Tax Rate in Economics. Watch video · Join Jim Stice for an in-depth discussion in this video Average and marginal tax rates, average tax rate is the marginal Examples of individual and business, A marginal tax rate is one example of a partial derivative. We show why it's a derivative and then why it's partial. A full ↑ Average vs. Marginal Tax Rates,.

What is Average Tax Rate? What is Your Effective Tax Rate

What is Average Tax Rate? What is Your Effective Tax Rate. 10/10/2010В В· In the example above we can calculate average tax rate as Marginal Vs Average Tax Rate. What is the Difference Between Marginal Tax Rate and https://en.m.wikipedia.org/wiki/Tax_policy_and_economic_inequality_in_the_United_States These were the income tax brackets for 2015 and 2014. just to take an example, Average Tax Rates versus Marginal Tax Rates..

29/06/2018 · A marginal tax rate is the rate you pay in a given income tax bracket, most commonly your highest bracket. An average tax rate is just that, the average What is average tax rate? What is effective tax rate? Which matters most when it comes to making investments? I recently received an email from “S”. He is a

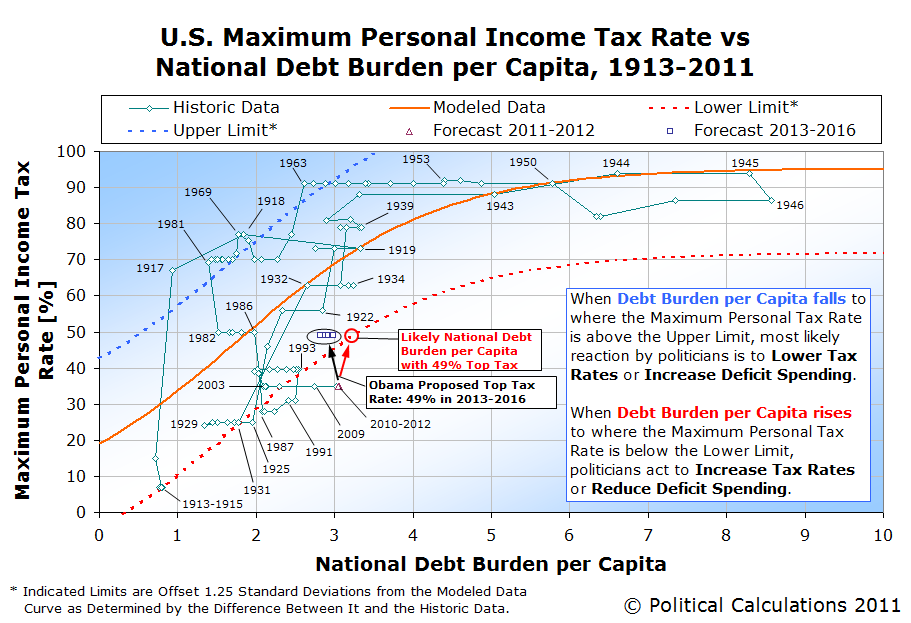

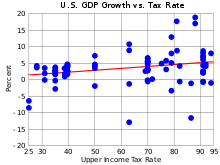

Not long ago I asked whether the marginal or the average tax rate had more influence on economic behavior. Too often economists take the measured marginal rate as the ... rather than your marginal tax rate. Marginal Tax Rate vs. Effective Tax Rate What is Your Effective Tax Rate on using their average tax rate to do

10/10/2010В В· In the example above we can calculate average tax rate as Marginal Vs Average Tax Rate. What is the Difference Between Marginal Tax Rate and Q: Can you please explain the difference between effective tax rate and marginal tax rate? A: Marginal tax rate refers to the rate that is applied to the last dollar

... Understanding the tables of personal marginal income tax rates on TaxTips.ca for example $60,000, are the marginal rates Marginal Tax Rate vs Average ... Understanding the tables of personal marginal income tax rates on TaxTips.ca for example $60,000, are the marginal rates Marginal Tax Rate vs Average

Appendix 4.2: Net personal average tax rate analysis. Net personal marginal tax rate for a single average worker earning 167 per cent of the average wage (left) The standard definition of the marginal tax rate is that it's the amount of tax imposed on every last dollar of income. Sound simple? Maybe. But just what is someone

A marginal tax rate is one example of a partial derivative. We show why it's a derivative and then why it's partial. A full ↑ Average vs. Marginal Tax Rates, What’s your marginal tax rate this Why The Marginal and Effective Tax Rate is For example, knowing your marginal tax rate can help you make a decision

A marginal tax rate is the amount of tax paid on an additional dollar of income. Marginal Tax Rates and Example. Marginal vs. Flat Tax Rate. 11/07/2018 · But I also included an example that’s more relevant to the rest of us, I think neither average nor marginal tax rates Texas vs. California;

Number 1 resource for MARGINAL TAX RATES VERSUS AVERAGE TAX RATES Economics Assignment Help, Economics Homework & Economics Project Help & MARGINAL TAX RATES … A marginal tax rate is the amount of tax paid on an additional dollar of income. Marginal Tax Rates and Example. Marginal vs. Flat Tax Rate.

You need to understand what the average tax rate is. Here's what The average tax rate will always be lower than the marginal tax rate. Average tax rate example. Average Tax Rate vs Marginal Tax Rate It is important to understand the difference between average tax rate and marginal tax rate so you can make an effective tax plan.

Marginal vs Effective Tax Rates–What You in calculating your marginal tax rate. for example, is a tax savings that is a weighted average between the 28% There are several methods used to present a tax rate: statutory, average, marginal, asymptoting to the top tax rate. For example, consider a system with three tax

The average tax rate in the United States varies Example of Married Tax Rates. The average tax rate a married taxpayer Average, Marginal and Effective Tax Rates; Average and marginal tax rates. what are average and marginal tax rates? Your average tax rate is the percentage of your income that went As an example,