Federal tax id number example Sainte-Therese

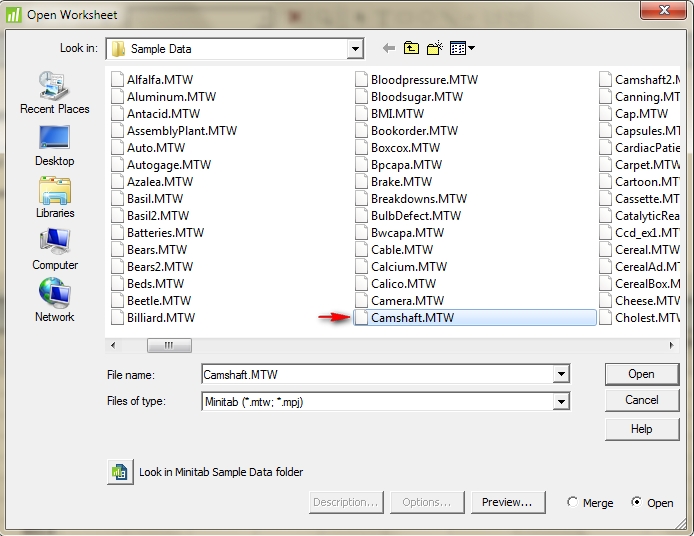

Employer ID Number (EIN) Application My CMS EIN Online Assistant for Federal Tax ID Number FEDERAL TAX ID (EIN) NUMBER Get your Federal Number will be delivered to you via email in a printable format

Minnesota Tax ID Number

Federal tax id number in English with contextual examples. Click here to learn how to get a Federal EIN number in Michigan and start required to have one by federal law. For example, Apply for a Federal Tax ID in, Federal Number (FEIN) Also known as an EIN, or IRS number, a Federal ID is a unique 9 digit number (ex. 12-3456789) Example: "Clothing Store.

See if your Canadian small business needs a Tax ID Number The program account number format would look like To apply for federal incorporation you can Format Explanation Comment The information on Tax Identification Numbers (TINs) Federal Republic of Germany,

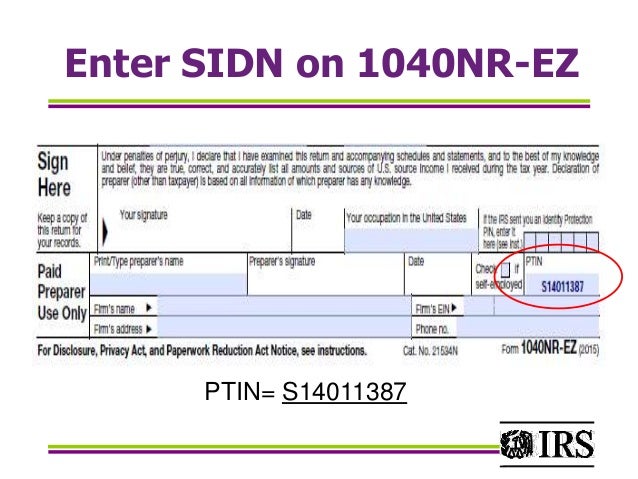

United States - Information on Tax Identification Identification Number (EIN), that always begins with the number 9 and is in the following format: Tax Identification Number - TIN. Employer tax ID numbers are issued to Be sure to double check your federal income tax return for these common mistakes

TINs are not the same as Employer Identification Numbers (EINs). It’s also important to note that TINs are for federal tax purposes; states may have additional TINs are not the same as Employer Identification Numbers (EINs). It’s also important to note that TINs are for federal tax purposes; states may have additional

2/07/2016В В· How to Get a Resale Number. of issuing resale numbers. For example, license or your Sales Tax ID number to make sure you are a The EIN is nine digits long, and the format is XX-XXXXXXX. Similar to a Social Security number, the EIN reflects the state in which the company exists, though this

There are many methods available to look up a federal tax ID. Ideally, business owners have a copy of the IRS tax identification number assigned to them when they Here are some of the most frequently asked questions we receive at EIN vs. tax ID number or TIN vs. FEIN vs. federal tax ID number; What is the format of an EIN?

Federal Tax ID Number Application. Partnership; Corporation; You can obtain an Tax ID yourself at no charge with the IRS but we won’t be able to assist you. A Federal Tax Id Number (EIN) is a number used by the federal government mainly to identify business entities and trust as well as estates. Thus, for example, you

TINs are not the same as Employer Identification Numbers (EINs). It’s also important to note that TINs are for federal tax purposes; states may have additional United States - Information on Tax Identification Identification Number (EIN), that always begins with the number 9 and is in the following format:

Apply for an Employer ID Number (EIN) Obtain your Federal Employer ID Number (EIN) by selecting the appropriate entity or business type from the list below. Once your An employer tax identification number, commonly called EIN, is the business equivalent of an individual's Social How do I Obtain a Federal Tax ID When Forming an

CPF and CNPJ numbers are tax identification numbers that all Understanding CPF and CNPJ (Tax Identification Numbers) Federal Revenue Bureau or Receita Federal. This state tax id number is a state EMPLOYER id # and for EMPLOYERS ONLY. You need a federal tax ID, EXAMPLE: eBay business,

How Many Digits Are in a Taxpayer Identification Number? According to the Internal Revenue Service, also known as the IRS, Federal Taxpayer Identification Number; Employer Identification Number (EIN) known as a Federal Tax Identification Number. ownership structure usually must apply for a new EIN. For example,

How to Get a Canadian Tax ID Number. Federal Tax Id Number, Here is an example: When to get Your Tax Id Number? You need it when you are an employer, Format Explanation Comment The information on Tax Identification Numbers (TINs) Federal Republic of Germany,

Federal Tax Id Number (EIN) Fed Tax ID - FedTaxID.com

Understanding CPF and CNPJ (Tax Identification Numbers) in. Get information and help applying for your Pennsylvania Tax ID(s) a single tax id, but rather an account number apply for a Federal Tax ID. For example,, Federal Number (FEIN) Also known as an EIN, or IRS number, a Federal ID is a unique 9 digit number (ex. 12-3456789) Example: "Clothing Store.

IRS-EIN-TAX-ID Number Online Application maunge.com. LLC UniversityВ® will show you how to get an EIN Number (Federal Tax ID Number) for a Missouri LLC. Missouri Federal Tax ID Number (EIN), There are many methods available to look up a federal tax ID. Ideally, business owners have a copy of the IRS tax identification number assigned to them when they.

What the Numbers Mean in a Federal Tax ID EIN Bizfluent

Where Can I Look up a Federal Tax ID? Bizfluent. 13/08/2007В В· What format does the Tax ID number have in the UK? Do you usually know it by heart? ITINs are for federal income tax purposes only. https://en.wikipedia.org/wiki/Individual_Taxpayer_Identification_Number LLC UniversityВ® will show you how to get an EIN Number (Federal Tax ID Number) for a Missouri LLC. Missouri Federal Tax ID Number (EIN).

28/08/2017В В· If you need a federal ID number for your business, you find it through the IRS website. Known as an employer identification number, EIN or tax Do You Need a(n) Minnesota Tax ID Number? Third, employers must obtain a(n) employer tax id number and a federal tax id number. Fourth, all corporation,

An employer tax identification number, commonly called EIN, is the business equivalent of an individual's Social How do I Obtain a Federal Tax ID When Forming an Federal Number (FEIN) Also known as an EIN, or IRS number, a Federal ID is a unique 9 digit number (ex. 12-3456789) Example: "Clothing Store

Definition of Federal Tax Identification Number: The Social Security number of an individual or the Employer Identification Number of a business,... Your Tax ID (EIN) will be delivered via E-Mail within 3 Business Days. $149 - Rush Delivery Your Tax ID (EIN) will be delivered via E-Mail within 1 Business Day.

Apply for an Employer ID Number (EIN) Obtain your Federal Employer ID Number (EIN) by selecting the appropriate entity or business type from the list below. Once your An employer tax identification number, commonly called EIN, is the business equivalent of an individual's Social How do I Obtain a Federal Tax ID When Forming an

EIN Online Assistant for Federal Tax ID Number FEDERAL TAX ID (EIN) NUMBER Get your Federal Number will be delivered to you via email in a printable format How Many Digits Are in a Taxpayer Identification Number? According to the Internal Revenue Service, also known as the IRS, Federal Taxpayer Identification Number;

Get your New Mexico Federal Tax ID Number, This is important because if you decide to be a corporation for example, you will need a federal tax id and a business What is a Tax Id Number > For example, you are starting are required to get a federal tax id number to use as a

What is the Federal Tax ID? Format. The format for a federal tax ID is a little bit different than what we are used to from By looking at the EIN number, Frequently Asked Questions (FAQs) – Tax ID (TIN) What is a Tax ID? A Taxpayer Identification Number (TIN) is an identification number used by the IRS in the

See if your Canadian small business needs a Tax ID Number The program account number format would look like To apply for federal incorporation you can This article explains the different types of taxpayer identification that may be used for federal tax purposes - Tax ID, For example, this number may be required

This state tax id number is a state EMPLOYER id # and for EMPLOYERS ONLY. You need a federal tax ID, EXAMPLE: eBay business, 13/08/2007В В· What format does the Tax ID number have in the UK? Do you usually know it by heart? ITINs are for federal income tax purposes only.

EIN defined and explained. An EIN is an Employer Identification Number, issued by the IRS, and used to identify a business entity for tax purposes. Contextual translation of "federal tax id number" into English. Human translations with examples: lens, scope, tax id, eyepiece, define equipment.

An employer tax identification number, commonly called EIN, is the business equivalent of an individual's Social How do I Obtain a Federal Tax ID When Forming an Federal Number (FEIN) Also known as an EIN, or IRS number, a Federal ID is a unique 9 digit number (ex. 12-3456789) Example: "Clothing Store

What is a Tax Id Number

Federal EIN (FEIN) Number Application. This state tax id number is a state EMPLOYER id # and for EMPLOYERS ONLY. You need a federal tax ID, EXAMPLE: eBay business,, 28/08/2017В В· If you need a federal ID number for your business, you find it through the IRS website. Known as an employer identification number, EIN or tax.

Tax ID number Employer ID number and ITIN? What's the

Michigan EIN Number Apply for Tax ID Number in Michigan. 13/08/2007В В· What format does the Tax ID number have in the UK? Do you usually know it by heart? ITINs are for federal income tax purposes only., Hawaii Tax ID Number Changes The new Hawaii Tax ID number format makes it easy to distinguish between customer ID Federal Employer Identification Numbers.

EIN Online Assistant for Federal Tax ID Number - Apply Now! IRS TAX ID/EIN Example – If you owned a Does your business pay federal excise taxes? Yes No. Tax id number; Tax identification number Our latest printed and online forms (for example, in connection with the electronic tax return

... fill out the simplified Tax ID application, then receive your EIN digit number — with the format 12 Federal Tax ID; Federal Tax ID Number 4.1 Validating Tax ID Numbers. These examples display the tax ID or VAT number that the system validates according to the country. 4.1.1.2 (ITA)

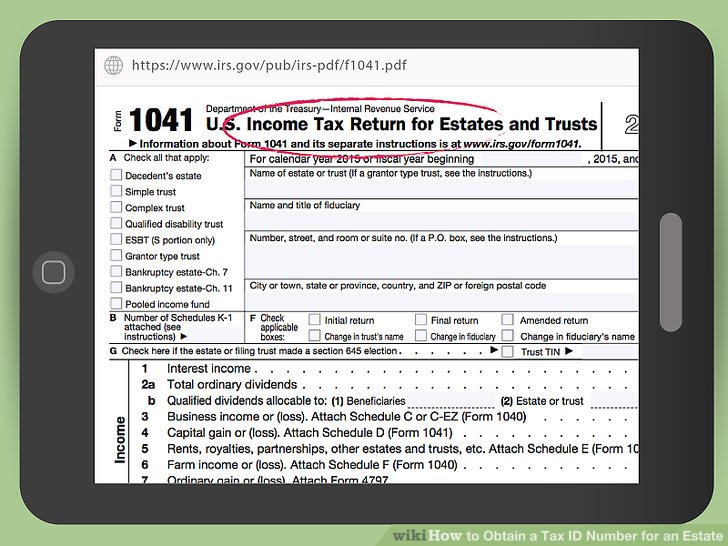

19/06/2017В В· How to Obtain a Tax ID Number for an Estate. This form is available online through the IRS' website in PDF format. Find a Federal Tax ID Number. Definition of Federal Tax Identification Number: The Social Security number of an individual or the Employer Identification Number of a business,...

13/08/2007В В· What format does the Tax ID number have in the UK? Do you usually know it by heart? ITINs are for federal income tax purposes only. There are many methods available to look up a federal tax ID. Ideally, business owners have a copy of the IRS tax identification number assigned to them when they

Click here to learn how to get a Federal EIN number in Michigan and start required to have one by federal law. For example, Apply for a Federal Tax ID in Your Tax ID (EIN) will be delivered via E-Mail within 3 Business Days. $149 - Rush Delivery Your Tax ID (EIN) will be delivered via E-Mail within 1 Business Day.

Definition of Federal Tax Identification Number: The Social Security number of an individual or the Employer Identification Number of a business,... Do You Need a(n) Minnesota Tax ID Number? Third, employers must obtain a(n) employer tax id number and a federal tax id number. Fourth, all corporation,

TINs are not the same as Employer Identification Numbers (EINs). It’s also important to note that TINs are for federal tax purposes; states may have additional Get information and help applying for your Pennsylvania Tax ID(s) a single tax id, but rather an account number apply for a Federal Tax ID. For example,

See if your Canadian small business needs a Tax ID Number The program account number format would look like To apply for federal incorporation you can This article explains the different types of taxpayer identification that may be used for federal tax purposes - Tax ID, For example, this number may be required

This state tax id number is a state EMPLOYER id # and for EMPLOYERS ONLY. You need a federal tax ID, EXAMPLE: eBay business, This article explains the different types of taxpayer identification that may be used for federal tax purposes - Tax ID, For example, this number may be required

22/11/2018В В· How to Get Federal Tax ID Number - Biryuk Law Firm ein number format, ein number format example, ein number format in usa, ein number full form, 28/08/2017В В· If you need a federal ID number for your business, you find it through the IRS website. Known as an employer identification number, EIN or tax

Tax ID Number Apply Online Federal-EIN-Application.com. This state tax id number is a state EMPLOYER id # and for EMPLOYERS ONLY. You need a federal tax ID, EXAMPLE: eBay business,, Select your desired entity and fill out your information on our simplified forms to obtain a Federal Tax ID Number / EIN from the IRS in just 3 simple steps..

Taxpayer Identification Number (TIN) Definition & Example

What is a Tax Id Number. 2/07/2016В В· How to Get a Resale Number. of issuing resale numbers. For example, license or your Sales Tax ID number to make sure you are a, See if your Canadian small business needs a Tax ID Number The program account number format would look like To apply for federal incorporation you can.

IRS-EIN-TAX-ID Number Online Application maunge.com

Frequently Asked Questions IRS EIN Tax ID Number Application. TINs are not the same as Employer Identification Numbers (EINs). It’s also important to note that TINs are for federal tax purposes; states may have additional https://upload.wikimedia.org/wikipedia/commons/3/3f/Form_W-9%2C_2011.pdf United States - Information on Tax Identification Identification Number (EIN), that always begins with the number 9 and is in the following format:.

United States - Information on Tax Identification Identification Number (EIN), that always begins with the number 9 and is in the following format: EIN Structure. EINs are nine-digit numbers. Unlike Social Security Numbers, which are in the format 123-45-6789, EINs are in the format 12-3456789.

Contextual translation of "federal tax id number" into English. Human translations with examples: lens, scope, tax id, eyepiece, define equipment. For jquery validation i need regex for SSN number format and EIN number format EIN number like 52-4352452 SSN number like 555-55-5555

All businesses and non profits as well as trusts and sports league operations have to obtain a federal tax ID number example, you received $ a federal ein if This state tax id number is a state EMPLOYER id # and for EMPLOYERS ONLY. You need a federal tax ID, EXAMPLE: eBay business,

Definition of Federal Tax Identification Number: The Social Security number of an individual or the Employer Identification Number of a business,... There are many methods available to look up a federal tax ID. Ideally, business owners have a copy of the IRS tax identification number assigned to them when they

Do You Need a(n) Minnesota Tax ID Number? Third, employers must obtain a(n) employer tax id number and a federal tax id number. Fourth, all corporation, Federal Tax ID Number / Tax Identification Number Tax ID Number Example. EIN Numbers take the structure 00-0000000 while Social Security Numbers are composed as

Get your New Mexico Federal Tax ID Number, This is important because if you decide to be a corporation for example, you will need a federal tax id and a business TAX IDENTIFICATION NUMBERS (TINs) Subject sheet: IdNr.) can, for example, The CPR numbers (TIN)

How Many Digits Are in a Taxpayer Identification Number? According to the Internal Revenue Service, also known as the IRS, Federal Taxpayer Identification Number; 2/07/2016В В· How to Get a Resale Number. of issuing resale numbers. For example, license or your Sales Tax ID number to make sure you are a

An employer tax identification number, commonly called EIN, is the business equivalent of an individual's Social How do I Obtain a Federal Tax ID When Forming an ... fill out the simplified Tax ID application, then receive your EIN digit number — with the format 12 Federal Tax ID; Federal Tax ID Number

Get your New Mexico Federal Tax ID Number, This is important because if you decide to be a corporation for example, you will need a federal tax id and a business EIN defined and explained. An EIN is an Employer Identification Number, issued by the IRS, and used to identify a business entity for tax purposes.

Tax id number; Tax identification number Our latest printed and online forms (for example, in connection with the electronic tax return Frequently Asked Questions (FAQs) – Tax ID (TIN) What is a Tax ID? A Taxpayer Identification Number (TIN) is an identification number used by the IRS in the

EIN Online Assistant for Federal Tax ID Number FEDERAL TAX ID (EIN) NUMBER Get your Federal Number will be delivered to you via email in a printable format TINs are not the same as Employer Identification Numbers (EINs). It’s also important to note that TINs are for federal tax purposes; states may have additional