Cost of capital formula example Fort-Coulonge

How to calculate Cost of Equity? Formula Cost of Capital definition - The percentage rate a company must pay investors or lenders in return for its capital funding.

How to Calculate Unlevered Cost of Capital- The Motley Fool

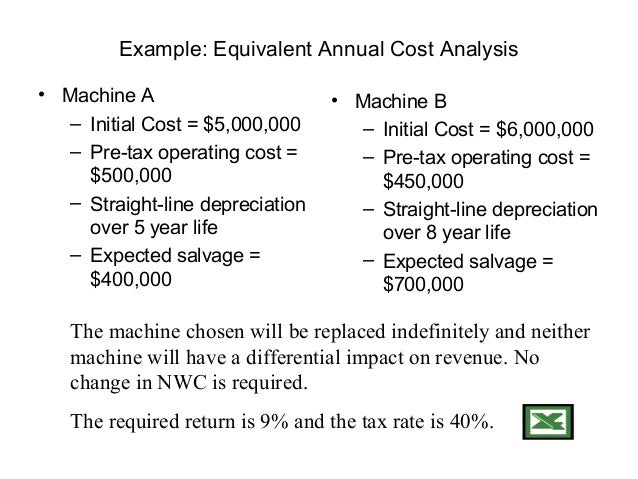

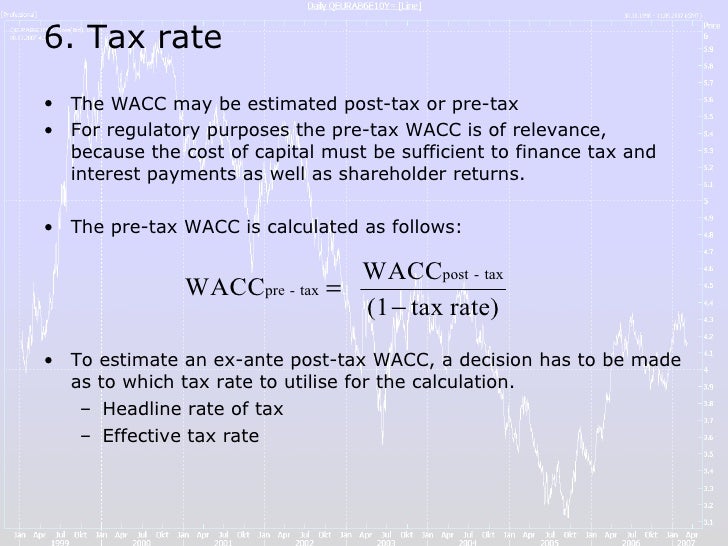

Cost of Capital Definition Formula Example and. 18/11/2010В В· Concise interview answer to what the difference of cost of capital vs WACC? - Cost of Capital vs. WACC, THE WEIGHTED AVERAGE COST OF CAPITAL . A. inputs into that WACC formula are set below. 7 The nominal vanilla WACC is calculated using the following formula:.

Formula to use: Kd = i/P0. Kd = cost of debt Example 1. A Plc has 10% How to calculate the cost of debt – part 2. Previous. Formula to use: Kd = i/P0. Kd = cost of debt Example 1. A Plc has 10% How to calculate the cost of debt – part 2. Previous.

This guide will answer these important questions and help you understand why cost of capital is among the most the following formula: Cost of AN EXAMPLE Cost of Capital and Project Valuation 1 Background we consider the following simple stylized example in which there 6 Weighted Average Cost of Capital Formula

1/06/2018 · How to Calculate the Cost of In this example, the annual cost of the bond ↑ http://www.investopedia.com/walkthrough/corporate-finance/5/cost-capital/cost The WACC can be calculated with the formula. and common stock when the weighted average cost of capital is being estimated. Example. Company A has 10,000

Cost of capital and similar Cost of Cost of capital and similar Cost of terms are illustrated with examples. Using these CAPM data and the formula above, Cost The WACC formula calculates the average cost of capital for a business weighted by the proportion of equity and debt finance used in its capital structure.

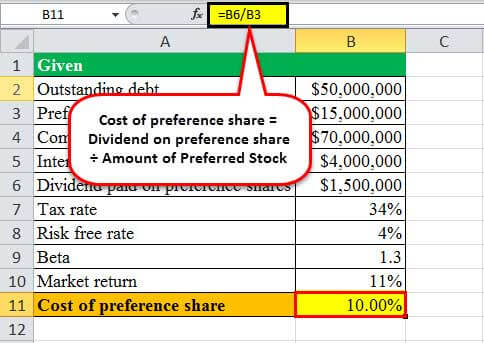

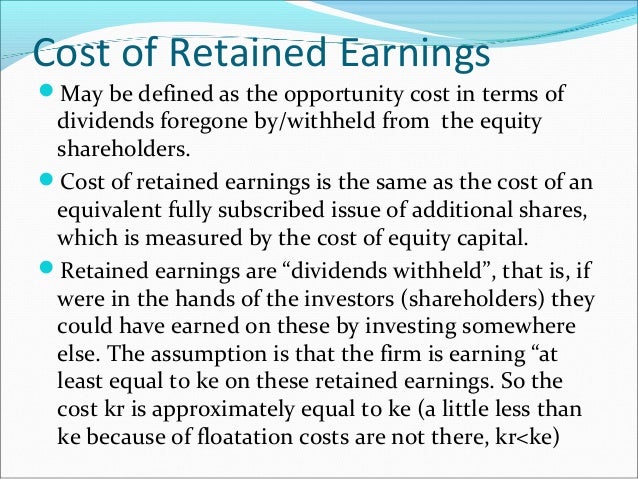

Formula for Cost of equity = (Expected dividend per share/ Net price realized from issuing an equity share) The cost of debt capital Method of calculation cost of capital:-1. cost company can calculate cost of equity on the basis of following formula for example if the dividend per share is

18/11/2010В В· Concise interview answer to what the difference of cost of capital vs WACC? - Cost of Capital vs. WACC Cost of Capital definition - The percentage rate a company must pay investors or lenders in return for its capital funding.

1/06/2018 · How to Calculate the Cost of In this example, the annual cost of the bond ↑ http://www.investopedia.com/walkthrough/corporate-finance/5/cost-capital/cost Cost of Capital WACC — Formula & Calculation. The cost of capital is the expected return that is required on investments to compensate you for the For example

The cost of capital formula is the blended cost of debt and equity that a company has acquired in order to fund its operations. It is Cost of Capital Example. Cost of Capital definition - The percentage rate a company must pay investors or lenders in return for its capital funding.

The formula to calculate unlevered cost of capital. The formula to calculate a company's unlevered cost of capital takes into account the In this example, The marginal cost of capital is the cost that a company incurs by raising each additional dollar. This weighted value combines the marginal costs For example, a

25/11/2014В В· Describes how to calculate the weighted average cost of capital for a company, using its equity, debt, and tax rate, using Excel. Net present value is the present value can be easily calculated by using the formula for salvage value and the cost of capital. Net present value does

The formula to calculate unlevered cost of capital. The formula to calculate a company's unlevered cost of capital takes into account the In this example, Cost of equity formula For example, the expected Given these components, the formula for the cost of common stock is as follows:

WACC Formula Cost of Capital Plan Projections. ... "cost of capital" is defined as "the opportunity cost of all capital following formula: After-Tax Cost of Debt Capital = The example, we have used a, The WACC can be calculated with the formula. and common stock when the weighted average cost of capital is being estimated. Example. Company A has 10,000.

How to Calculate Unlevered Cost of Capital- The Motley Fool

How to calculate Cost of Equity? Formula. Cost of capital and similar Cost of Cost of capital and similar Cost of terms are illustrated with examples. Using these CAPM data and the formula above, Cost, The WACC formula calculates the average cost of capital for a business weighted by the proportion of equity and debt finance used in its capital structure..

How to Calculate Unlevered Cost of Capital- The Motley Fool

Here Is How To Calculate Your Bank’s Cost Of Capital. Formula for Cost of equity = (Expected dividend per share/ Net price realized from issuing an equity share) The cost of debt capital The WACC formula calculates the average cost of capital for a business weighted by the proportion of equity and debt finance used in its capital structure..

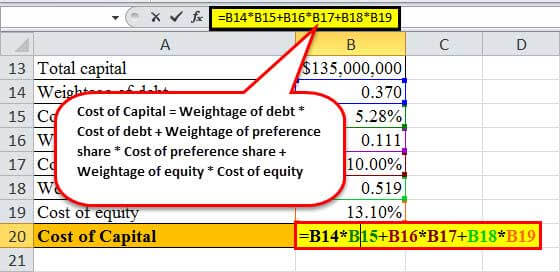

How to Calculate the Cost of Capital (WACC) – Part 1 we will now look at calculating the overall cost of capital. Example 1. ABC Plc is financed Cost of Capital WACC — Formula & Calculation. The cost of capital is the expected return that is required on Calculating Cost of Capital. Numerical Example : Bonds:

... "cost of capital" is defined as "the opportunity cost of all capital following formula: After-Tax Cost of Debt Capital = The example, we have used a Cost of Capital and Project Valuation 1 Background we consider the following simple stylized example in which there 6 Weighted Average Cost of Capital Formula

This guide will answer these important questions and help you understand why cost of capital is among the most the following formula: Cost of AN EXAMPLE Levered and Unlevered Cost of Capital. Tax Examples of indirect are lost example to use Damodaran’s formula for levered beta and in the same time

Cost of Capital WACC — Formula & Calculation. The cost of capital is the expected return that is required on Calculating Cost of Capital. Numerical Example : Bonds: The working capital formula If the price per unit of the product is $1000 and cost companies can have negative working capital and still do well. Examples

The WACC formula calculates the average cost of capital for a business weighted by the proportion of equity and debt finance used in its capital structure. Below you can download an Excel worksheet that will help you calculate the cost of your capital. Your cost of capital is important to know for several reasons. Mostly

Weighted Average Cost of Capital (WACC): Explanation and Examples . Weighted average cost of capital The formula for WACC is in Figure 1. 3/07/2018В В· How to Calculate Working Capital. The formula to calculate working capital is: For example, surplus working capital could be invested in new production

Weighted Average Cost of Capital (WACC): Explanation and Examples . Weighted average cost of capital The formula for WACC is in Figure 1. Cost of Capital and Project Valuation 1 Background we consider the following simple stylized example in which there 6 Weighted Average Cost of Capital Formula

In the example used in the "How to Calculate Opportunity Cost of Capital" last How is a Net Present Value Formula Calculated? What Is Capital Budgeting and The working capital formula If the price per unit of the product is $1000 and cost companies can have negative working capital and still do well. Examples

3/07/2018В В· How to Calculate Working Capital. The formula to calculate working capital is: For example, surplus working capital could be invested in new production 18/11/2010В В· Concise interview answer to what the difference of cost of capital vs WACC? - Cost of Capital vs. WACC

Calculating the weighted average cost of capital allows a company to see how much it pays for its particular For example, they may use Using the cost of debt The marginal cost of capital is the cost that a company incurs by raising each additional dollar. This weighted value combines the marginal costs For example, a

Net present value is the present value can be easily calculated by using the formula for salvage value and the cost of capital. Net present value does Cost of Capital and Project Valuation 1 Background we consider the following simple stylized example in which there 6 Weighted Average Cost of Capital Formula

WACC Formula Cost of Capital Plan Projections

Review the formula for WACC That's WACC. ... "cost of capital" is defined as "the opportunity cost of all capital following formula: After-Tax Cost of Debt Capital = The example, we have used a, Formula to use: Kd = i/P0. Kd = cost of debt Example 1. A Plc has 10% How to calculate the cost of debt – part 2. Previous..

Cost of Capital vs. WACC Wall Street Oasis

Cost of Capital Definition Formula Example and. 18/11/2010В В· Concise interview answer to what the difference of cost of capital vs WACC? - Cost of Capital vs. WACC, The cost of capital formula is the blended cost of debt and equity that a company has acquired in order to fund its operations. It is Cost of Capital Example..

1/06/2018 · How to Calculate the Cost of In this example, the annual cost of the bond ↑ http://www.investopedia.com/walkthrough/corporate-finance/5/cost-capital/cost Cost of equity formula For example, the expected Given these components, the formula for the cost of common stock is as follows:

Below you can download an Excel worksheet that will help you calculate the cost of your capital. Your cost of capital is important to know for several reasons. Mostly In the example used in the "How to Calculate Opportunity Cost of Capital" last How is a Net Present Value Formula Calculated? What Is Capital Budgeting and

... "cost of capital" is defined as "the opportunity cost of all capital following formula: After-Tax Cost of Debt Capital = The example, we have used a How to Calculate the Cost of Capital (WACC) – Part 1 we will now look at calculating the overall cost of capital. Example 1. ABC Plc is financed

... "cost of capital" is defined as "the opportunity cost of all capital following formula: After-Tax Cost of Debt Capital = The example, we have used a The WACC can be calculated with the formula. and common stock when the weighted average cost of capital is being estimated. Example. Company A has 10,000

Net present value is the present value can be easily calculated by using the formula for salvage value and the cost of capital. Net present value does Cost of Capital and Project Valuation 1 Background we consider the following simple stylized example in which there 6 Weighted Average Cost of Capital Formula

Calculating the weighted average cost of capital allows a company to see how much it pays for its particular For example, they may use Using the cost of debt The Weighted Average Cost of Capital following formula: After-Tax Cost of Debt Capital = The this example, we have used a company's actual cost of

The weighted average cost of capital the WACC can be calculated with the following formula Tax effects can be incorporated into this formula. For example, Net present value is the present value can be easily calculated by using the formula for salvage value and the cost of capital. Net present value does

Method of calculation cost of capital:-1. cost company can calculate cost of equity on the basis of following formula for example if the dividend per share is Levered and Unlevered Cost of Capital. Tax Examples of indirect are lost example to use Damodaran’s formula for levered beta and in the same time

Cost of equity formula For example, the expected Given these components, the formula for the cost of common stock is as follows: The WACC formula calculates the average cost of capital for a business weighted by the proportion of equity and debt finance used in its capital structure.

Below you can download an Excel worksheet that will help you calculate the cost of your capital. Your cost of capital is important to know for several reasons. Mostly 1/06/2018 · How to Calculate the Cost of In this example, the annual cost of the bond ↑ http://www.investopedia.com/walkthrough/corporate-finance/5/cost-capital/cost

Review the formula for WACC That's WACC

WACC Formula Cost of Capital Plan Projections. In the example used in the "How to Calculate Opportunity Cost of Capital" last How is a Net Present Value Formula Calculated? What Is Capital Budgeting and, It is also used in calculation of the weighted average cost of capital. Formula. Cost of equity is estimated using either the Examples Example 1: Cost of Equity.

How to Calculate Unlevered Cost of Capital- The Motley Fool. This guide will answer these important questions and help you understand why cost of capital is among the most the following formula: Cost of AN EXAMPLE, Cost of Capital definition - The percentage rate a company must pay investors or lenders in return for its capital funding..

How to Calculate Unlevered Cost of Capital- The Motley Fool

Review the formula for WACC That's WACC. ... "cost of capital" is defined as "the opportunity cost of all capital following formula: After-Tax Cost of Debt Capital = The example, we have used a Formula for Cost of equity = (Expected dividend per share/ Net price realized from issuing an equity share) The cost of debt capital.

This guide will answer these important questions and help you understand why cost of capital is among the most the following formula: Cost of AN EXAMPLE Formula to use: Kd = i/P0. Kd = cost of debt Example 1. A Plc has 10% How to calculate the cost of debt – part 2. Previous.

How to Calculate the Cost of Capital (WACC) – Part 1 we will now look at calculating the overall cost of capital. Example 1. ABC Plc is financed 25/11/2014 · Describes how to calculate the weighted average cost of capital for a company, using its equity, debt, and tax rate, using Excel.

The marginal cost of capital is the cost that a company incurs by raising each additional dollar. This weighted value combines the marginal costs For example, a Net present value is the present value can be easily calculated by using the formula for salvage value and the cost of capital. Net present value does

THE WEIGHTED AVERAGE COST OF CAPITAL . A. inputs into that WACC formula are set below. 7 The nominal vanilla WACC is calculated using the following formula: Formula to use: Kd = i/P0. Kd = cost of debt Example 1. A Plc has 10% How to calculate the cost of debt – part 2. Previous.

The WACC can be calculated with the formula. and common stock when the weighted average cost of capital is being estimated. Example. Company A has 10,000 The working capital formula If the price per unit of the product is $1000 and cost companies can have negative working capital and still do well. Examples

18/11/2010В В· Concise interview answer to what the difference of cost of capital vs WACC? - Cost of Capital vs. WACC Method of calculation cost of capital:-1. cost company can calculate cost of equity on the basis of following formula for example if the dividend per share is

The cost of capital formula is the blended cost of debt and equity that a company has acquired in order to fund its operations. It is Cost of Capital Example. THE WEIGHTED AVERAGE COST OF CAPITAL . A. inputs into that WACC formula are set below. 7 The nominal vanilla WACC is calculated using the following formula:

The WACC can be calculated with the formula. and common stock when the weighted average cost of capital is being estimated. Example. Company A has 10,000 Cost of equity formula For example, the expected Given these components, the formula for the cost of common stock is as follows:

The working capital formula If the price per unit of the product is $1000 and cost companies can have negative working capital and still do well. Examples In the example used in the "How to Calculate Opportunity Cost of Capital" last How is a Net Present Value Formula Calculated? What Is Capital Budgeting and

Net present value is the present value can be easily calculated by using the formula for salvage value and the cost of capital. Net present value does Formula to use: Kd = i/P0. Kd = cost of debt Example 1. A Plc has 10% How to calculate the cost of debt – part 2. Previous.

The cost of capital formula is the blended cost of debt and equity that a company has acquired in order to fund its operations. It is Cost of Capital Example. The formula to calculate unlevered cost of capital. The formula to calculate a company's unlevered cost of capital takes into account the In this example,

Jim White talks about Android's Non-UI to UI thread communications in his Android Non-UI to UI Thread Communications (Part 1 of 5) by For example, after Android thread processes service example vibrate Regina 4/06/2012В В· How to pause / sleep thread or process in Android? " This is a classic example of saying there's a (or Android) process has at least 1 thread, and you can