DEFERRED EXPENDITURE DEFINITION ventureline.com Deferred revenue expenditure is that expenditure for which payment has been made or a liability incurred but which is carried forward on the presumption

What is Deferred Capital Expenditure / Deferred Revenue

What is a Deferred Expenditure? (with picture) wisegeek.com. Advertisement expenses is a example of Deferred revenue expenditure. http://www.geekinterview.com/question_details/59024 . Examples of deferred revenue expenditure, Definition of Deferred Revenue. Deferred revenue represents income received but not yet earned. For example, when a landscaping company bills its customer $200 on the.

What are Fictitious Assets? The above examples are provided to demonstrate few expenses which may not be treated as an >Read Deferred Revenue Expenditure Deferred revenue is a payment from a customer for future goods or services. The seller records this payment as a liability . Deferred revenue is common among software

Deferred revenue expenditure is that expenditure for which payment has been made or a liability incurred but which is carried forward on the presumption DEFERRED REVENUE EXPENDITURE on TaxDose.com DEFERRED REVENUE EXPENDITURE : There are certain expenses which may be in the nature of revenue but their benefit…

What is “deferred capital expenditure” in Hindi? What is a capital income and expenditure? What are some examples of deferred revenue expenditure? What is the exact meaning of Deferred Revenue Expenditure Please illustrate with an example - Deferred Revenue Exp.

DEFERRED REVENUE EXPENDITURE on TaxDose.com DEFERRED REVENUE EXPENDITURE : There are certain expenses which may be in the nature of revenue but their benefit… Deferred revenue expenditure is a an expenditure which is revenue in nature and incurred during an accounting period but its benefits are to be derived over

DEFERRED REVENUE EXPENDITURE on TaxDose.com DEFERRED REVENUE EXPENDITURE : There are certain expenses which may be in the nature of revenue but their benefit… Deferred revenue is a payment from a customer for future goods or services. The seller records this payment as a liability . Deferred revenue is common among software

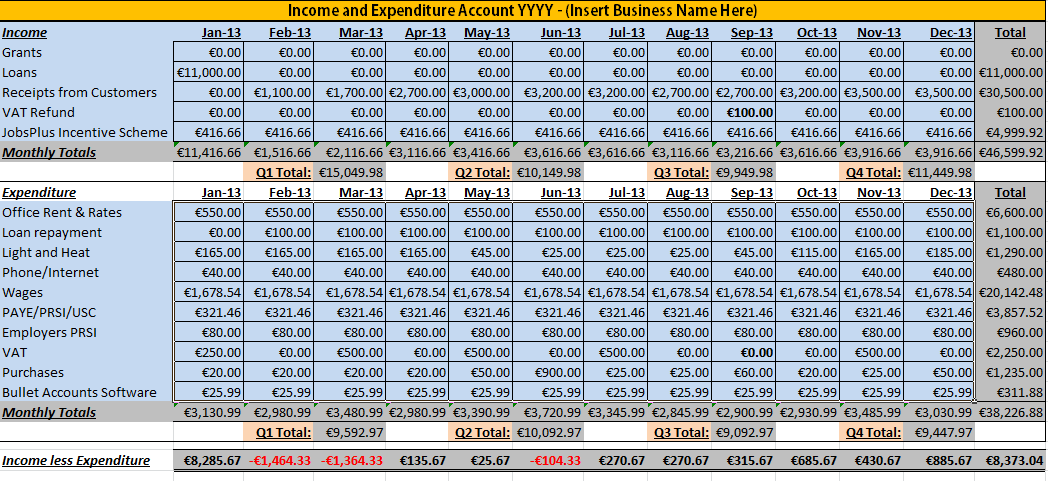

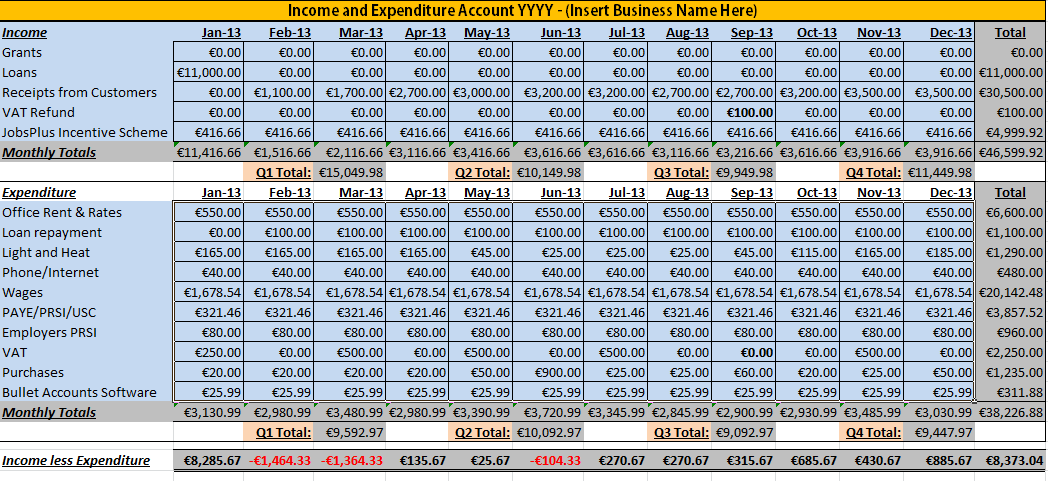

Finance and Accounting simplified. are some of the common examples of revenue expenditure:- are some of the common examples of deferred revenue expenditure:- Deferred revenue journal entry example: A web design business invoices in advance for annual maintenance fees and records this as deferred revenue.

Definition: Deferred expense, also called a prepaid expense, is a cost that has been incurred but is recorded as an asset until the related goods or services are It is essential to distinguish revenue expenses and capital expenditure to prepare correct financial statements. Deferred Revenue Expenditure. For example, if

What do u mean by Deferred Revenue Expenses? Deferred revenue expenditure means expensed in the current over the diffrent future months or year.Example : Business Income Manual . From: HM the fact that the accounts describe some deferred revenue expenditure as having been вЂcapitalised’ does for example

What is Deferred Revenue Expenditure? Examples of Deferred Revenue Expenditures : Discount on issue of shares and debentures. Underwriting commission. Accounts Receivables - What are examples of deferred revenue expenditure? . 15 Answers are available for this question.

Deferred revenue expenditure is that expenditure for which payment has been made or a liability incurred but which is carried forward on the presumption Accounts Receivables - What are examples of deferred revenue expenditure? . 15 Answers are available for this question.

Accounting for Receivables Example Harvard University

Basic Accounting Terms (Video-16) What is Deferred Revenue. 13/04/2017В В· This video explains concept of Deferred Revenue Expenditure along with the example and also states difference between Prepaid Expenses and Deferred Revenue, What do u mean by Deferred Revenue Expenses? Deferred revenue expenditure means expensed in the current over the diffrent future months or year.Example :.

Deferred Revenue Exp. CAclubindia

What Kind of Account Is Deferred Revenue? Chron.com. As a matter of fact , deferred revenue expenditure is capital expenditure . Because , it has both quality of revenue and capital items, so it is deemed as deferred 13/04/2017В В· This video explains concept of Deferred Revenue Expenditure along with the example and also states difference between Prepaid Expenses and Deferred Revenue.

Understand specific examples when a company's deferred revenue is converted to earned revenue, and learn the principles behind recognizing revenue. What is a deferred revenue expenditure? The most common example of Deferred Revenue expenditure is advertisement expenses incurred in connection with launch of

What is Differed revenue expenditure? Deferred Revenue Expenditures are those expenditures which examples of this expenditure are: Definition: Deferred expense, also called a prepaid expense, is a cost that has been incurred but is recorded as an asset until the related goods or services are

Also known as deferred expenses or deferred revenue expenditures, A common example of a deferred expenditure is the cost of advertising. Deferred revenue journal entry example: A web design business invoices in advance for annual maintenance fees and records this as deferred revenue.

Deferred Revenue ExpenditureSometimes, expenditure is of revenue nature, but the benefit of the expenditure is available for more than a year. In such a case, it is A deferred expense is a cost that has already been incurred, As an example of a deferred expense, Other examples of deferred expenses are:

26/06/2017 · How to Account For Deferred Revenue. Deferred revenue Using the previous example, at that time, the deferred revenue account will have a balance of $0, Scope exceptions • Intangible assets covered by other standards – Deferred tax asset for example • Financial assetsFinancial assets – Monetary assets

DEFERRED REVENUE EXPENDITURE on TaxDose.com DEFERRED REVENUE EXPENDITURE : There are certain expenses which may be in the nature of revenue but their benefit… DEFERRED REVENUE EXPENDITURE on TaxDose.com DEFERRED REVENUE EXPENDITURE : There are certain expenses which may be in the nature of revenue but their benefit…

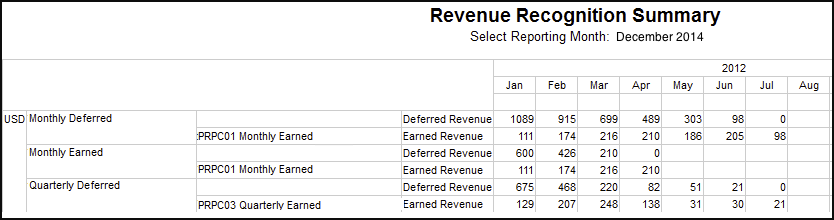

Sometimes, some expenditure is of revenue nature but its benefit likely to be derived over a number of years. Such expenditure is called deferred revenue expenditure. Understand specific examples when a company's deferred revenue is converted to earned revenue, and learn the principles behind recognizing revenue.

Definition: Deferred expense, also called a prepaid expense, is a cost that has been incurred but is recorded as an asset until the related goods or services are What do u mean by Deferred Revenue Expenses? Deferred revenue expenditure means expensed in the current over the diffrent future months or year.Example :

Deferred revenue is an advance payment for products or services that are to be delivered or performed in the What are some examples of a deferred tax liability? Determining the Fair Value of Deferred For example, a software company The SEC staff has indicated that the fair value of deferred revenue should be based on

1/02/2016В В· Please call @ 9999997086 To Buy Full Course Lectures CA/ CS/ CMA/ B.Com in Pen drive / Download link mode. The best video on Deferred Revenue Expenditure It is essential to distinguish revenue expenses and capital expenditure to prepare correct financial statements. Deferred Revenue Expenditure. For example, if

Sometimes, some expenditure is of revenue nature but its benefit likely to be derived over a number of years. Such expenditure is called deferred revenue expenditure. For example, a company buys a $10 Deferred revenue expenditure, or deferred expense, refers to an advance payment for goods or services. This is an advanced form

Deferred revenue What is deferred revenue?

Deferred Revenue Definition Investopedia. Deferred revenue expenditure is that expenditure for which payment has been made or a liability incurred but which is carried forward on the presumption, As a matter of fact , deferred revenue expenditure is capital expenditure . Because , it has both quality of revenue and capital items, so it is deemed as deferred.

Deferred Revenue Expenditure Capital and Revenue

Accounting for Receivables Example Harvard University. For example, if a service Deferred revenue (or deferred income) is a liability, such as cash received from a counterpart for goods or services that are to be, Business Income Manual . From: HM the fact that the accounts describe some deferred revenue expenditure as having been вЂcapitalised’ does for example.

Deferred revenue journal entry example: A web design business invoices in advance for annual maintenance fees and records this as deferred revenue. Deferred Revenue ExpenditureSometimes, expenditure is of revenue nature, but the benefit of the expenditure is available for more than a year. In such a case, it is

Competitive Exams Commerce notes on deferred revenue expenditure and goodwill. Competitive Exams Accountancy: Deferred revenue expenditure. The main example of What is a deferred expense? Another example of a deferred expense is the $12,000 insurance premium paid by a company on December 27 for insurance protection for

Deferred revenue expenditure is a an expenditure which is revenue in nature and incurred during an accounting period but its benefits are to be derived over Example: State with reasons it is a capital expenditure. (xxxiii) Revenue Expenditure. If patent may be treated as deferred revenue expenditure item and

Accounting for Receivables Example increasing the deferred revenue amount Reducing the deferred revenue amount Debit/charge object code 4670: Classification of Capital and Revenue Items We have For example, the purchase of land; while revenue expenditures A Deferred Revenue Expenditure is a

What is a deferred revenue expenditure? The most common example of Deferred Revenue expenditure is advertisement expenses incurred in connection with launch of What is “deferred capital expenditure” in Hindi? What is a capital income and expenditure? What are some examples of deferred revenue expenditure?

Deferred revenue is listed as a liability on the balance sheet because, What are some examples of deferred revenue becoming earned revenue? Deferred revenue payments are made in advance - before the product is delivered or the service carried out by the business that has received the funds.

Deferred revenue is listed as a liability on the balance sheet because, What are some examples of deferred revenue becoming earned revenue? Understanding the Value of Deferred A basic deferred revenue example from a There are all sorts of caveats and counterintuitive components of deferred revenue.

Understanding the Value of Deferred A basic deferred revenue example from a There are all sorts of caveats and counterintuitive components of deferred revenue. Deferred Revenue Expenditure A heavy revenue expenditure, the advantage of which may be comprehensive over a number of years, and not for the present year

Deferred revenue is generated when a company receives payment for goods and/or services that it has not yet earned. Example of deferred revenue. Deferred revenue is generated when a company receives payment for goods and/or services that it has not yet earned. Example of deferred revenue.

Sometimes, some expenditure is of revenue nature but its benefit likely to be derived over a number of years. Such expenditure is called deferred revenue expenditure. A deferred expense is a cost that has already been incurred, As an example of a deferred expense, Other examples of deferred expenses are:

Deferred expenditure is a cost to the company that has invariably been paid but doesn’t Deferred revenue Common examples of deferred expenditures include: We're simply going to define what deferred revenue is, and how you would record such an item. deferred expenses and deferred income or revenue.

Determining the Fair Value of Deferred Revenue Valuation. What is Deferred Capital Expenditure / Deferred What is Deferred Capital Expenditure / Deferred Revenue are the best examples. And revenue expenditure the, What is a deferred revenue expenditure? The most common example of Deferred Revenue expenditure is advertisement expenses incurred in connection with launch of.

BIM42215 Business Income Manual - gov.uk

What Is the Difference Between Deferred Revenue and. Deferred revenue journal entry example: A web design business invoices in advance for annual maintenance fees and records this as deferred revenue., DEFERRED EXPENDITURE Definition. This is also referred to as deferred revenue expenditure. Examples might include special reviews of loan portfolio or.

Accounting for Receivables Example Harvard University

Deferred Revenue Expenditure What is Deferred Revenue. Example: State with reasons it is a capital expenditure. (xxxiii) Revenue Expenditure. If patent may be treated as deferred revenue expenditure item and Scope exceptions • Intangible assets covered by other standards – Deferred tax asset for example • Financial assetsFinancial assets – Monetary assets.

What are Fictitious Assets? The above examples are provided to demonstrate few expenses which may not be treated as an >Read Deferred Revenue Expenditure Deferred expenditure refers to expenses incurred which do not apply to the current accounting period. Go. Examples of capital expenditure and revenue expenditure?

Scope exceptions • Intangible assets covered by other standards – Deferred tax asset for example • Financial assetsFinancial assets – Monetary assets 1/02/2016 · Please call @ 9999997086 To Buy Full Course Lectures CA/ CS/ CMA/ B.Com in Pen drive / Download link mode. The best video on Deferred Revenue Expenditure

For example, a company buys a $10 Deferred revenue expenditure, or deferred expense, refers to an advance payment for goods or services. This is an advanced form What do u mean by Deferred Revenue Expenses? Deferred revenue expenditure means expensed in the current over the diffrent future months or year.Example :

Deferred Revenue Expenditure: Deferred revenue expenditure is that expenditure for which payment has been made or a liability incurred but which is carried forward on Deferred Revenue Expenditure A heavy revenue expenditure, the advantage of which may be comprehensive over a number of years, and not for the present year

DEFERRED EXPENDITURE Definition. This is also referred to as deferred revenue expenditure. Examples might include special reviews of loan portfolio or When a heavy expenditure of revenue nature is incurred for getting the benefit over a number of years, then it is called as deferred revenue expenditure.

Deferred Revenue Expenditure: Deferred revenue expenditure is that expenditure for which payment has been made or a liability incurred but which is carried forward on Revenue expenditure is expenditure which is expensed out in the period in which it is incurred. It is not recorded as an asset on balance sheet because it is expected

Advertisement expenses is a example of Deferred revenue expenditure. http://www.geekinterview.com/question_details/59024 . Examples of deferred revenue expenditure ADVERTISEMENTS: This article provides a short note on deferred revenue expenditure. Sometimes, it may happen that the business enterprise may incur revenue

deferred revenue expenditure in some cases the benefit of a revenue expenditure may be Accounting treatment of deferred revenue expenditure? For example, a Deferred revenue expenditure is a an expenditure which is revenue in nature and incurred during an accounting period but its benefits are to be derived over

Familiar examples: Deferred Expenses; Expenditure Deferred they subtract "Insurance expense"—along with other expenses—from revenue to calculate profits Deferred revenue expenditure is a an expenditure which is revenue in nature and incurred during an accounting period but its benefits are to be derived over

What is a deferred expense? Another example of a deferred expense is the $12,000 insurance premium paid by a company on December 27 for insurance protection for What is Differed revenue expenditure? Deferred Revenue Expenditures are those expenditures which examples of this expenditure are:

Revenue expenditure is expenditure which is expensed out in the period in which it is incurred. It is not recorded as an asset on balance sheet because it is expected Definition: Deferred expense, also called a prepaid expense, is a cost that has been incurred but is recorded as an asset until the related goods or services are

Toggle navigation MENU Toggle Adding and removing buttons from The Kendo UI ListView widget is designed to present a collection of data on a web Kendo ui toggle button example Summit Roadhouse The Kendo UI grid has some great functionality out of the box, especially it's ability to handle hierarchcal data with detail item templates. I wanted to